Passive income refers to earnings generated with minimal ongoing effort from the recipient. This type of income typically stems from investments, real estate, or online business ventures. Unlike active income, which requires continuous work, passive income allows individuals to earn money while engaging in other activities or even sleeping.

It is a popular strategy for building wealth and achieving financial independence. Various forms of passive income exist, including rental income from properties, stock dividends, royalties from creative works, and affiliate marketing commissions. The key principle of passive income is establishing systems or investments that generate recurring revenue with minimal ongoing involvement.

While initial setup may require time, money, or effort, the ultimate goal is to create self-sustaining income streams. Understanding passive income concepts and generation methods is essential for individuals seeking to diversify their income sources and build long-term wealth. However, it is crucial to recognize that passive income is not a quick path to riches and often demands patience, persistence, and strategic planning.

Before pursuing passive income opportunities, individuals should carefully assess their financial objectives and risk tolerance. When approached with the right mindset and strategy, passive income can serve as an effective tool for attaining financial independence and securing a stable financial future.

Key Takeaways

- Passive income is income that is earned with little to no effort on the part of the recipient.

- Online business opportunities such as e-commerce, dropshipping, and digital products can be lucrative sources of passive income.

- Successful streams of passive income require careful planning, consistent effort, and a willingness to adapt to market changes.

- Real estate investments can provide a steady stream of passive income through rental properties, real estate crowdfunding, and property appreciation.

- Dividend stocks offer a way to generate passive income by earning a share of the company’s profits without having to sell any of your stock.

Exploring Online Business Opportunities

Dropshipping: A Popular Online Business Model

One of the most popular online business models for passive income is dropshipping, where individuals can sell products without holding inventory or dealing with shipping logistics.

Digital Products and Affiliate Marketing

Another lucrative online business opportunity is creating and selling digital products such as e-books, online courses, or software. Once these products are created and marketed, they can continue to generate income for the creator without requiring ongoing effort. Affiliate marketing is also a popular way to earn passive income online by promoting products or services and earning a commission on sales generated through affiliate links.

Content Creation and Monetization

For those with a passion for writing or creating content, blogging or vlogging can be a great way to generate passive income through advertising, sponsored content, and affiliate marketing. With the right niche and content strategy, individuals can build a loyal audience and monetize their platforms for passive income.

Creating Successful Streams of Passive Income

Creating successful streams of passive income requires careful planning, research, and execution. One of the most common ways to generate passive income is through rental properties. Investing in real estate properties that can be rented out for long-term or short-term leases can provide a steady stream of passive income.

However, it is important to carefully consider factors such as location, property management, and market demand before investing in rental properties. Another way to create successful streams of passive income is through dividend-paying stocks. By investing in established companies that pay regular dividends to shareholders, individuals can earn passive income from their stock holdings.

It is important to conduct thorough research and due diligence before investing in dividend stocks to ensure a steady and reliable income stream. Creating successful streams of passive income also involves exploring alternative investment opportunities such as peer-to-peer lending or creating digital assets like online courses or e-books. Peer-to-peer lending platforms allow individuals to lend money to others in exchange for interest payments, providing a passive income stream with potentially higher returns than traditional savings accounts.

Creating digital assets involves creating valuable content or resources that can be sold or licensed for passive income. Ultimately, creating successful streams of passive income requires a combination of smart investing, strategic planning, and ongoing management. It is important for individuals to diversify their passive income streams to minimize risk and maximize potential returns.

Leveraging Passive Income through Real Estate Investments

| Real Estate Investment | Passive Income | Benefits |

|---|---|---|

| Rental Property | Rental income from tenants | Steady cash flow, property appreciation |

| Real Estate Investment Trusts (REITs) | Dividend payments | Diversification, professional management |

| Real Estate Crowdfunding | Share of rental income or profits | Access to larger properties, lower investment threshold |

Real estate investments have long been a popular way to generate passive income. From rental properties and vacation rentals to real estate investment trusts (REITs) and real estate crowdfunding, there are various ways to leverage real estate for passive income. Rental properties can provide a steady stream of passive income through monthly rent payments from tenants.

However, it is important for investors to carefully consider factors such as property location, market demand, and property management before investing in rental properties. Vacation rentals have also become a popular way to generate passive income through platforms like Airbnb and VRBO. By renting out vacation properties to travelers, individuals can earn passive income while also enjoying personal use of the property during off-peak times.

Real estate investment trusts (REITs) are another way to leverage real estate for passive income by investing in publicly traded companies that own and manage income-generating properties. Real estate crowdfunding platforms allow individuals to invest in real estate projects with lower capital requirements and without the hassle of property management. By pooling funds with other investors, individuals can earn passive income from rental income or property appreciation without the need for hands-on involvement.

Leveraging passive income through real estate investments requires careful consideration of factors such as risk tolerance, market conditions, and investment goals.

Investing in Dividend Stocks for Passive Income

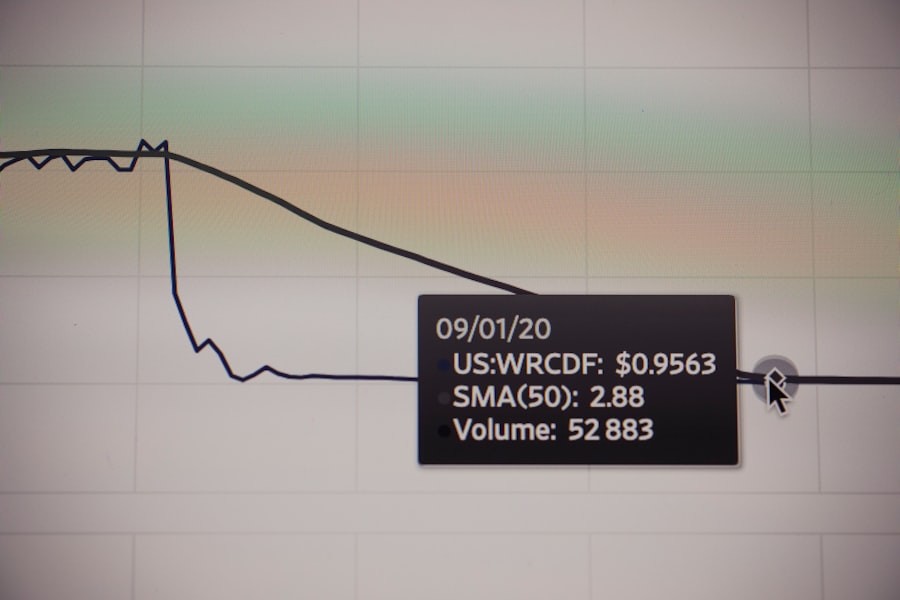

Investing in dividend stocks is a popular way to generate passive income by earning regular dividend payments from established companies. Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. By investing in dividend-paying stocks, individuals can earn passive income from their stock holdings without having to sell shares.

Dividend stocks are often considered a more stable and reliable source of passive income compared to growth stocks or speculative investments. Companies that pay regular dividends typically have a track record of stable earnings and strong financial performance. By investing in dividend stocks, individuals can benefit from both potential stock price appreciation and regular dividend payments.

It is important for individuals to conduct thorough research and due diligence before investing in dividend stocks to ensure a steady and reliable income stream. Factors such as company financials, dividend history, industry trends, and market conditions should be carefully considered when selecting dividend stocks for passive income. Diversifying across different sectors and industries can also help minimize risk and maximize potential returns when investing in dividend stocks.

Generating Passive Income through Affiliate Marketing

Benefits of Affiliate Marketing

One of the key benefits of affiliate marketing is the ability to earn passive income without having to create or manage products or services. By leveraging existing products or services and promoting them to a target audience, individuals can earn commissions on sales without the need for inventory or customer support. Affiliate marketing also allows individuals to diversify their income streams by promoting products or services across different industries and niches.

Key to Success in Affiliate Marketing

To be successful in affiliate marketing, individuals should focus on building trust with their audience and providing valuable content that aligns with the products or services being promoted. It is important to choose reputable affiliate programs with high-quality products or services that resonate with the target audience.

Generating Passive Income through Affiliate Marketing

By creating compelling content and strategically promoting affiliate offers, individuals can generate passive income through affiliate marketing.

Building a Passive Income Portfolio through Peer-to-Peer Lending

Peer-to-peer lending has emerged as a popular way to build a passive income portfolio by lending money to others in exchange for interest payments. Peer-to-peer lending platforms connect individual lenders with borrowers looking for personal or business loans. By investing in peer-to-peer lending opportunities, individuals can earn passive income from interest payments while diversifying their investment portfolio.

One of the key benefits of peer-to-peer lending is the potential for higher returns compared to traditional savings accounts or bonds. However, it is important for individuals to carefully assess the creditworthiness of borrowers and spread their investments across multiple loans to minimize risk. Peer-to-peer lending platforms often provide tools and resources to help investors evaluate potential loan opportunities and make informed investment decisions.

Building a passive income portfolio through peer-to-peer lending requires careful consideration of factors such as investment goals, risk tolerance, and diversification strategies. By investing in peer-to-peer lending opportunities with varying loan terms and risk profiles, individuals can create a balanced portfolio that generates steady passive income over time. It is important for investors to stay informed about market trends and economic conditions when building a passive income portfolio through peer-to-peer lending.

In conclusion, understanding the concept of passive income and the various ways it can be generated is crucial for individuals looking to diversify their income and build long-term wealth. Exploring online business opportunities such as dropshipping, digital products, affiliate marketing, and blogging can provide lucrative avenues for generating passive income. Creating successful streams of passive income involves careful planning, research, and execution across various investment opportunities such as real estate properties, dividend stocks, peer-to-peer lending, and digital assets.

Leveraging passive income through real estate investments offers opportunities for earning rental income from properties or investing in real estate crowdfunding platforms. Investing in dividend stocks provides a stable source of passive income through regular dividend payments from established companies. Generating passive income through affiliate marketing allows individuals to earn commissions on sales by promoting products or services through various channels.

Building a passive income portfolio through peer-to-peer lending offers opportunities for earning interest payments from individual or business loans while diversifying investment portfolios. Ultimately, creating successful streams of passive income requires patience, persistence, and strategic planning to achieve financial independence and create a more secure financial future. With the right mindset and approach, individuals can leverage various opportunities to build a diverse portfolio of passive income streams that provide long-term financial stability and freedom.

If you’re looking for ways to generate passive income, you might also be interested in learning about self-publishing through Amazon’s Kindle Direct Publishing (KDP) platform. Tasha Marie’s article “Pen Your Masterpiece with KDP: Embrace Your Creative Freedom” provides valuable insights into how to publish and sell your own books online. With KDP, you can tap into the growing market for e-books and potentially earn passive income from your writing. Check out the article here for more information.

FAQs

What is passive income?

Passive income is income that is earned with little to no effort on the part of the recipient. It is typically generated from an initial investment of time or money and continues to generate income with minimal ongoing effort.

What are some passive income ideas?

Some passive income ideas include investing in stocks or real estate, creating and selling digital products, renting out property, affiliate marketing, and creating a blog or YouTube channel.

How much money can you make from passive income?

The amount of money you can make from passive income varies depending on the specific idea and the amount of time and money you invest initially. Some passive income streams have the potential to generate a significant amount of income, while others may only provide a small supplemental income.

Is passive income taxable?

Yes, passive income is generally taxable. The tax treatment of passive income can vary depending on the specific source of income and the tax laws in your country.

What are the benefits of passive income?

The benefits of passive income include the potential to earn money with minimal ongoing effort, the ability to diversify your income streams, and the opportunity to build wealth over time. Passive income can also provide financial security and flexibility.