Passive income is a financial concept that refers to earnings generated with minimal ongoing effort from the recipient. This type of income is often associated with financial independence and wealth accumulation outside of traditional employment. Sources of passive income can include investments, online businesses, real estate, and various other ventures.

The primary appeal of passive income lies in its potential to create continuous revenue streams that persist even when the recipient is not actively working. This can provide financial stability and the opportunity for long-term wealth growth. However, it is important to note that establishing passive income streams typically requires significant initial effort, time, or financial investment.

Passive income is not a rapid path to wealth, but rather a strategic approach to building long-term financial security. It can be used to diversify income sources, bolster retirement savings, or work towards financial independence. Common methods for generating passive income include:

1.

Real estate investments

2. Dividend-paying stocks

3. Online businesses

4.

Digital product creation

5. Affiliate marketing

6. Rental properties

7.

Peer-to-peer lending

8. Royalties from intellectual property

While passive income can be a powerful tool for achieving financial goals, it requires careful planning, research, and often a willingness to take calculated risks. Success in generating passive income typically depends on factors such as market conditions, personal expertise, and the ability to identify and capitalize on opportunities.

Key Takeaways

- Passive income is money earned with minimal effort through various sources such as investments, online businesses, and real estate.

- Online business opportunities for passive income include e-commerce, dropshipping, and creating digital courses or content.

- Successful streams of passive income can come from rental properties, dividend-paying stocks, and royalties from creative work.

- Investing in real estate for passive income can provide steady rental income and potential property appreciation over time.

- Creating and selling digital products such as e-books, online courses, and stock photography can generate passive income through recurring sales.

- Passive income through affiliate marketing involves promoting other people’s products and earning a commission for each sale made through your referral.

- In conclusion, taking actionable steps such as diversifying income streams, automating processes, and consistently investing can help in generating passive income.

Online Business Opportunities for Passive Income

Dropshipping: A Low-Risk Option

One popular option is dropshipping, where you can set up an online store and sell products without ever having to handle inventory or shipping.

Digital Products: Create Once, Sell Repeatedly

Another option is creating and selling digital products such as e-books, online courses, or stock photography. These products can be created once and sold repeatedly, providing a steady stream of passive income over time. Affiliate marketing is another lucrative opportunity, where you can earn commissions by promoting other people’s products or services through your website or social media channels.

Monetizing Your Online Presence

In addition to these options, there are also opportunities for generating passive income through advertising revenue on websites or YouTube channels. By creating valuable content that attracts a large audience, you can earn money through ad placements or sponsorships. Building a successful online business takes time and effort, but the potential for passive income is significant.

By leveraging the power of the internet and digital technology, you can create a sustainable source of revenue that continues to grow over time.

Successful Streams of Passive Income

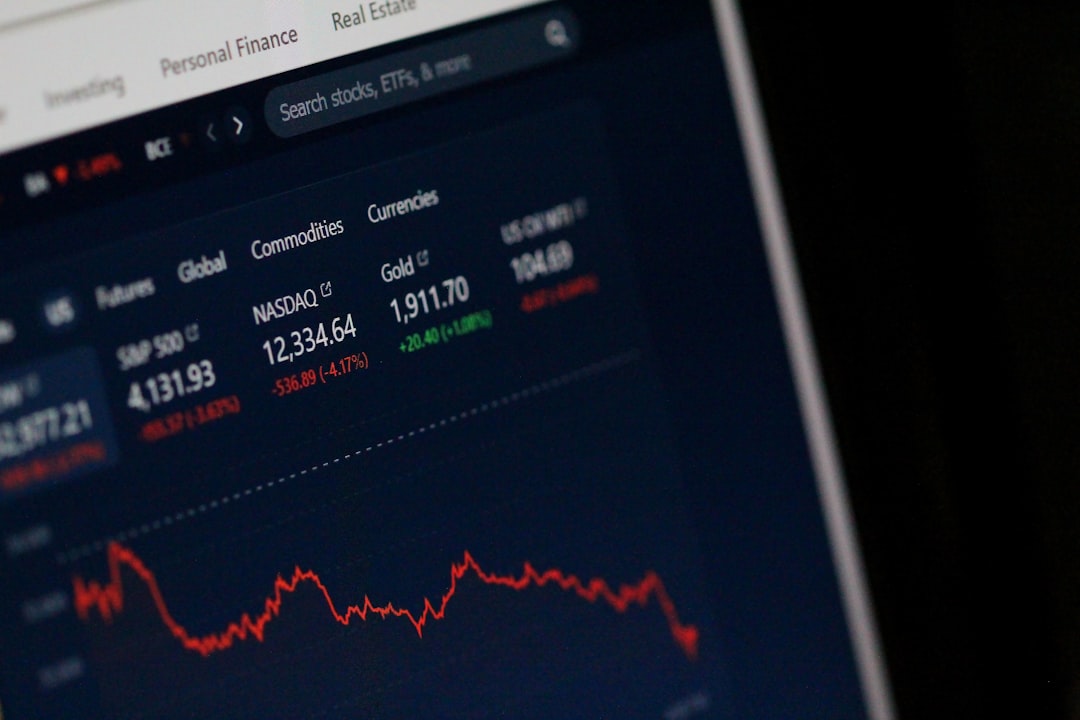

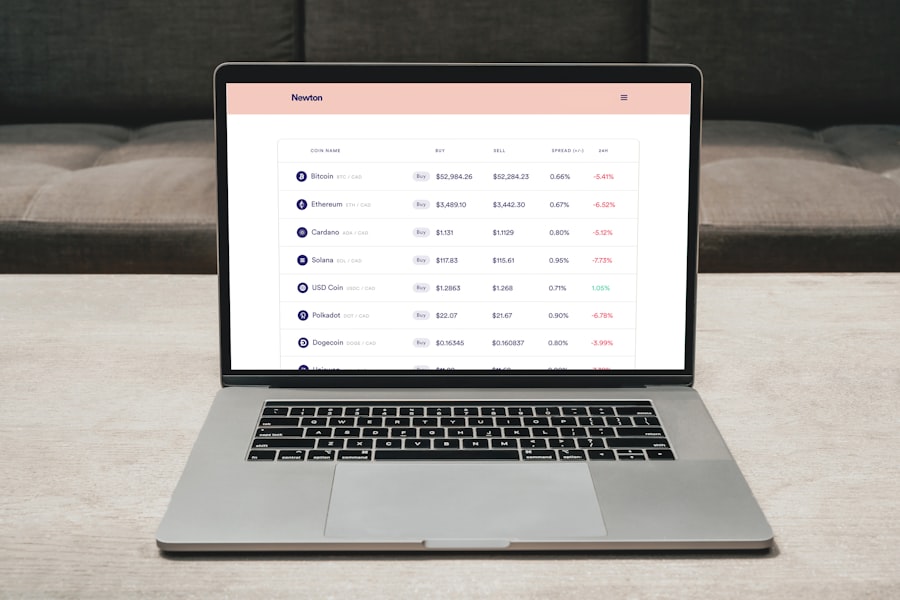

There are several successful streams of passive income that have proven to be lucrative for many entrepreneurs and investors. One popular option is dividend investing, where you can earn regular income by investing in stocks that pay dividends. This can provide a steady stream of passive income while also allowing for potential growth through stock appreciation.

Another successful stream of passive income is rental properties, where you can earn monthly rental income from tenants while also building equity in the property over time. Real estate crowdfunding is another option that allows you to invest in real estate projects without having to deal with the day-to-day management of properties. Another successful stream of passive income is creating and selling digital products such as e-books, online courses, or software.

Once created, these products can be sold repeatedly without requiring ongoing effort on your part. Additionally, affiliate marketing has proven to be a successful stream of passive income for many entrepreneurs. By promoting other people’s products or services, you can earn commissions on sales generated through your referral links.

These are just a few examples of successful streams of passive income that have the potential to provide long-term financial security and wealth accumulation.

Investing in Real Estate for Passive Income

| Metrics | Benefits |

|---|---|

| Rental Income | Steady cash flow from tenants |

| Appreciation | Potential increase in property value over time |

| Tax Advantages | Opportunity for tax deductions and benefits |

| Passive Income | Generate income with minimal ongoing effort |

| Portfolio Diversification | Investment diversification beyond stocks and bonds |

Investing in real estate is a popular and proven strategy for generating passive income. Rental properties can provide a steady stream of monthly income from tenants while also allowing for potential appreciation in property value over time. This can be a lucrative option for those who have the capital to invest in real estate and are willing to take on the responsibilities of property management.

Another option for investing in real estate is real estate crowdfunding, which allows investors to pool their resources to invest in larger real estate projects such as apartment buildings or commercial properties. This can provide the benefits of real estate investing without the need for hands-on management. Real estate investment trusts (REITs) are another option for generating passive income through real estate.

REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. By investing in REITs, you can earn regular dividends and potentially benefit from stock appreciation as well. Overall, investing in real estate can be a powerful way to generate passive income and build long-term wealth.

However, it’s important to carefully consider the risks and responsibilities involved in real estate investing before diving in.

Creating and Selling Digital Products for Passive Income

Creating and selling digital products is another popular avenue for generating passive income. Digital products such as e-books, online courses, software, and stock photography can be created once and sold repeatedly without requiring ongoing effort on your part. This makes them an attractive option for those looking to build a sustainable source of passive income.

E-books, in particular, have become a popular choice for many entrepreneurs and writers looking to monetize their expertise and knowledge. Online courses are another lucrative option, allowing you to create valuable educational content that can be sold to a wide audience. Software development is another avenue for creating and selling digital products for passive income.

By developing software applications or tools that solve specific problems or meet market demands, you can generate revenue through one-time sales or subscription models. Stock photography is yet another option for creating and selling digital products, allowing photographers to earn royalties each time their images are licensed for use. Overall, creating and selling digital products can be a profitable way to generate passive income while leveraging your skills and expertise.

Passive Income through Affiliate Marketing

Benefits of Affiliate Marketing

Affiliate marketing allows you to earn passive income without having to create or manage your own products, making it an attractive option for many entrepreneurs. There are various ways to approach affiliate marketing, including niche websites, product reviews, comparison sites, and influencer marketing on social media platforms.

Maximizing Earning Potential

By strategically selecting affiliate products that align with your audience’s interests and needs, you can maximize your earning potential while providing value to your followers.

Generating Passive Income

While affiliate marketing does require some initial effort to set up and promote affiliate links, it has the potential to generate passive income over time as your audience grows and engages with your content.

Conclusion and Actionable Steps for Generating Passive Income

In conclusion, passive income offers a powerful way to build wealth and achieve financial independence by creating streams of revenue that continue to flow with minimal effort. Whether through online businesses, real estate investments, digital product creation, or affiliate marketing, there are countless opportunities for generating passive income in today’s digital economy. To get started on your journey towards passive income generation, consider taking the following actionable steps: 1.

Research different opportunities for generating passive income and identify those that align with your skills, interests, and resources.

2. Develop a solid business plan or investment strategy that outlines your goals, target audience, revenue streams, and growth projections.

3. Invest in education and training to build the knowledge and skills necessary for success in your chosen avenue of passive income generation.

4.

Take consistent action towards building and growing your passive income streams, whether through creating valuable content, investing in real estate, or promoting affiliate products.

5. Monitor your progress and make adjustments as needed to optimize your passive income strategies and maximize your earning potential. By taking these actionable steps and staying committed to your goals, you can create sustainable streams of passive income that provide long-term financial security and freedom.

With dedication and perseverance, you can build a portfolio of passive income streams that support your lifestyle and future aspirations.

If you’re looking for more ways to generate passive income, you might be interested in learning about publishing on Amazon. Tasha Marie provides a step-by-step guide on how to get started with self-publishing, which can be a great way to earn passive income through book sales. Check out her article here for more information.

FAQs

What is passive income?

Passive income is earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved.

What are some passive income ideas for 2024?

Some passive income ideas for 2024 include investing in dividend stocks, creating and selling digital products, renting out property, affiliate marketing, and peer-to-peer lending.

How can I generate passive income?

You can generate passive income by investing in assets that produce regular income, creating and selling products or services, renting out property, or earning royalties from creative work.

Is passive income taxable?

Yes, passive income is generally taxable. The tax treatment of passive income can vary depending on the specific source of income and the tax laws in your jurisdiction.

What are the benefits of passive income?

The benefits of passive income include the potential for financial freedom, the ability to generate income with less active involvement, and the opportunity to build wealth over time.